GEICO quote for car insurance is a popular choice for drivers seeking affordable and reliable coverage. But navigating the world of insurance quotes can be overwhelming, especially with so many factors influencing your premium. This guide aims to demystify the process, offering insights into how GEICO calculates rates, the various coverage options available, and tips for securing the best possible quote.

From understanding the basics of car insurance terminology to exploring the benefits of choosing GEICO, we'll delve into the key aspects that matter most to you. We'll also compare GEICO to its competitors and provide strategies for negotiating lower premiums, ensuring you're equipped to make informed decisions about your car insurance needs.

Obtaining a GEICO Car Insurance Quote

Getting a car insurance quote from GEICO is a straightforward process. You have the flexibility to choose the method that best suits your preferences and needs. Let's explore the different ways to obtain a quote and their respective advantages and disadvantages.

Obtaining a Quote Online

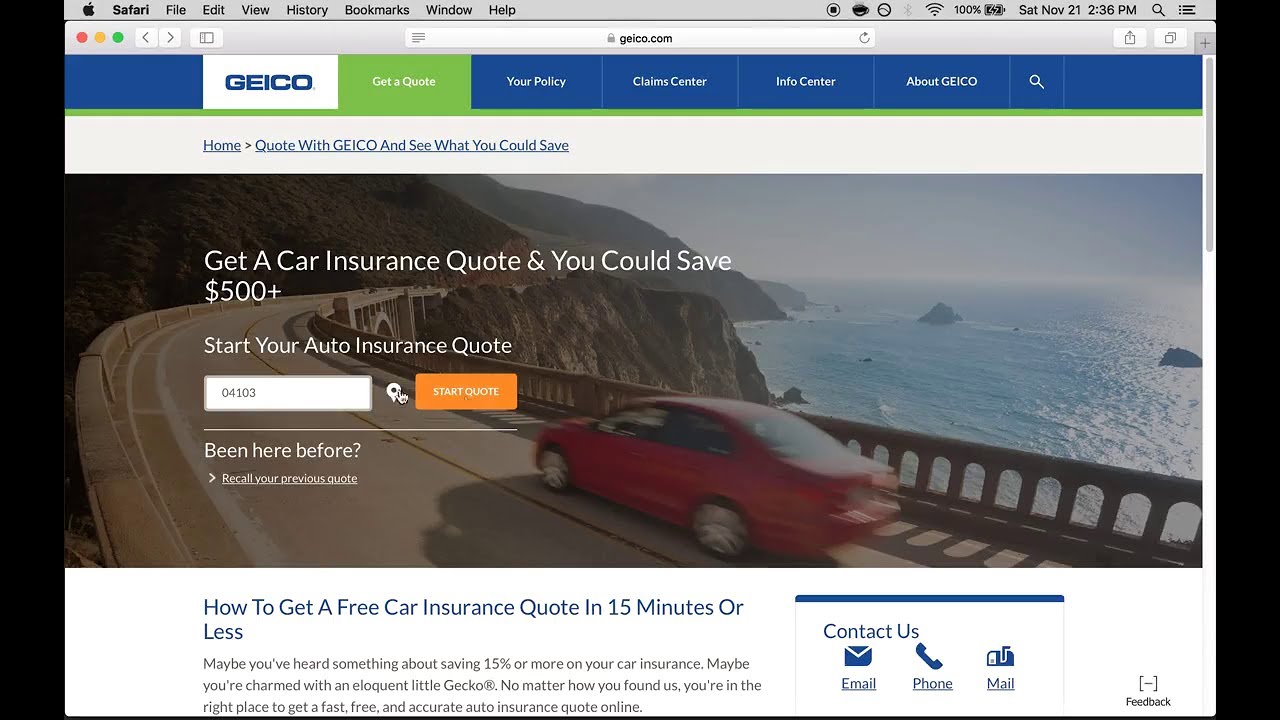

The online method offers a convenient and efficient way to get a quote. It allows you to complete the process at your own pace, anytime, anywhere. Here's a step-by-step guide to obtaining a quote online:- Visit the GEICO website: Start by navigating to the GEICO website (www.geico.com).

- Select "Get a Quote": Locate the "Get a Quote" button on the website's homepage. This will usually be prominently displayed.

- Enter Your Information: You'll be prompted to provide some basic information, including your zip code, the type of vehicle you want to insure, and your driving history.

- Review and Submit: After entering your information, review the quote details carefully. You can adjust your coverage options to find the best fit for your needs. Once you're satisfied, submit the quote request.

- Receive Your Quote: GEICO will send you a personalized quote via email or text message. You can then compare this quote to other insurance providers to make an informed decision.

Key Features of GEICO Car Insurance

GEICO offers a comprehensive range of car insurance options designed to meet the needs of various drivers. Their policies include a variety of coverage types, discounts, and unique features that can help you save money and protect your vehicle.Coverage Options

GEICO offers a variety of coverage options to protect you and your vehicle in the event of an accident or other incident. These options include:- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It includes bodily injury liability, which covers medical expenses and lost wages, and property damage liability, which covers repairs or replacement costs for damaged property.

- Collision Coverage: This coverage pays for repairs or replacement costs to your vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It can help cover your medical expenses and vehicle damage.

- Personal Injury Protection (PIP): This coverage, also known as "no-fault" insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident. It is required in some states.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is usually a lower coverage limit than PIP.

Benefits of Choosing GEICO Car Insurance

There are many benefits to choosing GEICO car insurance, including:- Competitive Rates: GEICO is known for offering competitive car insurance rates, which can help you save money. They use a variety of factors to determine your rate, including your driving history, vehicle type, location, and coverage options.

- Excellent Customer Service: GEICO has a reputation for providing excellent customer service. You can contact them 24/7 by phone, email, or online chat. They have a team of knowledgeable agents who can answer your questions and help you find the right coverage for your needs.

- Convenient Online and Mobile Tools: GEICO offers a variety of convenient online and mobile tools that make it easy to manage your policy. You can get quotes, make payments, file claims, and access your policy documents online or through the GEICO mobile app.

- Strong Financial Stability: GEICO is a financially strong company with a long history of providing reliable car insurance. This means you can have confidence that they will be there to help you when you need them.

Unique Features and Discounts

GEICO offers several unique features and discounts that can help you save money on your car insurance:- GEICO Emergency Roadside Assistance: This feature provides you with 24/7 roadside assistance in case of a flat tire, dead battery, lockout, or other emergency. It can help you get back on the road quickly and safely.

- GEICO Accident Forgiveness: This feature can help you avoid a rate increase if you have an accident, even if you are at fault. It is available in select states and may have eligibility requirements.

- GEICO DriveEasy: This program uses telematics technology to track your driving habits and reward you for safe driving. You can earn discounts on your insurance premium by driving safely and avoiding risky behaviors.

- GEICO Discounts: GEICO offers a variety of discounts that can help you save money on your car insurance. These discounts include:

- Good Driver Discount: For drivers with a clean driving record.

- Multi-Car Discount: For insuring multiple vehicles with GEICO.

- Multi-Policy Discount: For bundling your car insurance with other insurance policies, such as homeowners or renters insurance.

- Defensive Driving Course Discount: For completing a defensive driving course.

- Military Discount: For active military personnel or veterans.

- Student Discount: For good students with a high GPA.

Customer Experience with GEICO

GEICO boasts a strong reputation for its customer service, but like any large company, it has its share of pros and cons. Here's a look at what customers have to say about their experiences with GEICO.Customer Reviews and Testimonials

Many GEICO customers praise the company for its quick and efficient service. They appreciate the ease of obtaining quotes, filing claims, and getting in touch with customer service representatives.- "I've been with GEICO for years, and I've always been happy with their service. They're always quick to answer my questions and help me with any issues I've had." - Sarah M.

- "I recently got into a car accident, and GEICO was amazing. They handled everything for me, and I didn't have to worry about a thing." - John S.

GEICO Customer Service Pros and Cons

- Pros:

- 24/7 customer service: GEICO offers customer support around the clock, which is convenient for customers who need assistance outside of regular business hours.

- Multiple contact options: Customers can reach GEICO by phone, email, or online chat, providing flexibility for different preferences.

- Easy-to-use website and mobile app: GEICO's digital platforms are designed for user-friendliness, making it easy for customers to manage their policies, file claims, and access information.

- Cons:

- Long wait times: While GEICO offers 24/7 support, customers may experience long wait times, especially during peak hours.

- Limited personalized service: Some customers may find the automated systems and online interactions lacking the personalized touch they prefer.

- Challenges with claim processing: While GEICO generally has a good reputation for claim handling, some customers have reported delays or difficulties in receiving compensation.

Examples of GEICO's Claim Handling

GEICO aims to provide a smooth and efficient claims process for its customers.- Online claim filing: Customers can file claims online, simplifying the process and allowing for 24/7 access.

- Mobile app support: The GEICO mobile app provides access to claim information, updates, and communication with claims adjusters.

- Dedicated claims representatives: GEICO assigns dedicated claims representatives to each case, providing a single point of contact for customers throughout the process.

Comparing GEICO to Competitors

Choosing the right car insurance provider can be a daunting task, especially when you're considering the vast array of options available. GEICO, a well-known insurance company, has earned a reputation for its competitive rates and excellent customer service. However, it's essential to compare GEICO with other major providers to determine if it truly aligns with your specific needs and budget.

Comparing GEICO's Car Insurance Rates

GEICO's rates are often competitive, but it's crucial to compare them with other leading insurance providers to ensure you're getting the best deal. Several factors can influence car insurance rates, including your driving history, location, vehicle type, and coverage levels. Online comparison tools and insurance brokers can help you quickly and easily compare quotes from multiple companies, including GEICO.

Getting a GEICO quote for car insurance is a quick and easy process, especially if you're already familiar with the company. You can get a quote online, over the phone, or through a GEICO agent. If you're looking for a specific quote for Tennessee, you can find a comprehensive list of TN car insurance quotes from different companies, including GEICO.

Comparing quotes from multiple providers is always a good idea to find the best rates and coverage for your needs.

Strengths and Weaknesses of GEICO Compared to Competitors

GEICO boasts several strengths, including:

- Competitive Rates: GEICO is often known for offering lower premiums compared to its competitors, particularly for drivers with good driving records.

- Wide Coverage Options: GEICO provides a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Excellent Customer Service: GEICO consistently receives positive reviews for its responsive and helpful customer service. They offer multiple communication channels, including phone, email, and online chat.

- Convenient Online Tools: GEICO provides a user-friendly website and mobile app, making it easy to manage your policy, pay your premiums, and file claims.

However, GEICO also has some weaknesses:

- Limited Availability in Some States: GEICO doesn't operate in all states, which might limit its availability for some drivers.

- Potentially Higher Rates for High-Risk Drivers: While GEICO often offers competitive rates for good drivers, drivers with a history of accidents or violations might face higher premiums compared to other companies.

Key Features and Pricing of Top Car Insurance Providers

To illustrate the differences in features and pricing, here's a table comparing GEICO to some of its top competitors:

| Provider | Key Features | Average Annual Premium |

|---|---|---|

| GEICO | Competitive rates, wide coverage options, excellent customer service, convenient online tools | $1,464 |

| State Farm | Strong financial stability, wide range of discounts, excellent customer service | $1,538 |

| Progressive | Name Your Price tool, customizable coverage options, strong online presence | $1,492 |

| Allstate | Comprehensive coverage options, strong customer service, various discounts | $1,566 |

| Liberty Mutual | Strong financial stability, personalized coverage options, innovative safety features | $1,510 |

Note: These average annual premiums are estimates based on national data and may vary depending on individual factors like driving history, location, and vehicle type. It's essential to obtain personalized quotes from multiple providers to compare rates accurately.

Getting a GEICO quote for car insurance is a quick and easy process. You can easily compare rates and find the best coverage for your needs. If you're looking to explore other options, it's always a good idea to check out different providers. You can easily get car insurance quotes online getting car insurance quotes online , and then compare them to your GEICO quote.

This way, you can make sure you're getting the best possible deal on your car insurance.

Tips for Getting the Best GEICO Quote

Getting the best car insurance quote from GEICO involves a combination of smart strategies and a little bit of negotiation. By understanding your options and being prepared, you can significantly reduce your premiums and ensure you're getting the coverage you need at a price that works for you.Strategies for Lowering Car Insurance Premiums

There are several ways to lower your car insurance premiums. Some of these strategies involve making changes to your driving habits and vehicle choices, while others focus on taking advantage of discounts offered by GEICO.- Improve Your Driving Record: A clean driving record is the most significant factor in determining your car insurance premiums. Avoiding accidents, traffic violations, and DUI convictions will significantly lower your rates.

- Maintain a Good Credit Score: While not universally applicable, some insurance companies, including GEICO, consider your credit score when calculating your premiums. A higher credit score can lead to lower premiums.

- Choose a Safe Vehicle: The safety features and overall safety rating of your vehicle can impact your insurance premiums. Choosing a vehicle with advanced safety features like anti-lock brakes, airbags, and stability control can lead to lower rates.

- Consider a Higher Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums.

- Bundle Your Insurance Policies: If you have other insurance needs like homeowners or renters insurance, bundling them with your car insurance through GEICO can often result in significant discounts.

Negotiating with GEICO for a Better Rate

While GEICO's online quoting system provides a starting point, don't hesitate to negotiate for a better rate. Here are some tips:- Shop Around: Get quotes from other insurance companies to compare prices and coverage options. This information can be helpful when negotiating with GEICO.

- Highlight Your Positive Factors: Emphasize your good driving record, credit score, and any other factors that make you a low-risk driver.

- Be Prepared to Switch: If you're not satisfied with GEICO's offer, be prepared to switch to another insurer. This can create a sense of urgency and encourage them to negotiate.

- Be Polite and Persistent: Be polite and respectful during your negotiations, but be persistent in your efforts to get the best possible rate.

Factors to Consider Before Accepting a GEICO Quote

Before accepting a GEICO quote, it's crucial to consider the following factors:- Coverage Options: Ensure the quote includes the coverage you need, such as liability, collision, comprehensive, and uninsured motorist coverage.

- Deductibles: Understand the deductible amounts for different coverage options and how they impact your premiums.

- Discounts: Inquire about available discounts, such as safe driver discounts, good student discounts, and multi-car discounts.

- Customer Service: Consider GEICO's reputation for customer service and its ease of filing claims.

- Financial Stability: Research GEICO's financial stability to ensure they can pay out claims in the event of an accident.

Understanding Car Insurance Terminology

Navigating the world of car insurance can be confusing, especially when encountering unfamiliar terms. Understanding the language used in insurance policies is crucial to making informed decisions about your coverage. This section will define some of the most common car insurance terms and explain their significance in relation to your policy.Common Car Insurance Terms

Understanding the following terms will help you better comprehend your car insurance policy and make informed decisions about your coverage:- Deductible: This is the amount of money you pay out-of-pocket before your insurance company covers the rest of the claim. For example, if you have a $500 deductible and your car is damaged in an accident, you would pay the first $500 and your insurance company would cover the remaining cost of repairs. A higher deductible typically means a lower premium, while a lower deductible means a higher premium.

- Premium: The premium is the amount of money you pay to your insurance company for your car insurance coverage. The premium is typically paid monthly, quarterly, or annually. The amount of your premium depends on several factors, including your driving history, age, location, and the type of car you drive.

- Coverage Limits: Coverage limits refer to the maximum amount your insurance company will pay for a specific type of claim. For example, your liability coverage limit might be $100,000 per person and $300,000 per accident. This means that your insurance company will pay up to $100,000 for injuries to a single person and up to $300,000 for injuries to multiple people in a single accident.

- Liability Coverage: This type of coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of medical bills, lost wages, and property repairs. Liability coverage is usually required by law in most states.

- Collision Coverage: Collision coverage pays for repairs to your car if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is often recommended if you have a car loan or lease.

- Comprehensive Coverage: Comprehensive coverage protects your car from damage caused by events other than accidents, such as theft, vandalism, fire, or hail. This coverage is also optional.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical bills and property damage.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, pays for your medical expenses and lost wages after an accident, regardless of who is at fault. This coverage is required in some states.

Car Insurance for Different Situations: Geico Quote For Car Insurance

GEICO offers a range of car insurance options to cater to the diverse needs of its customers. From new drivers to high-risk drivers, and from luxury car owners to classic car enthusiasts, GEICO provides tailored coverage to suit individual circumstances. This section will delve into GEICO's car insurance options for different situations, including the coverage needs for specific vehicle types and examples of how GEICO adapts its policies to individual circumstances.Car Insurance for New Drivers

New drivers often face higher insurance premiums due to their lack of experience. GEICO understands this and offers various programs designed to help new drivers. For instance, GEICO's "Good Driver Discount" can help new drivers who maintain a clean driving record save money on their premiums. Additionally, GEICO's "Defensive Driving Course Discount" can further reduce premiums for new drivers who complete an approved defensive driving course.The Importance of Car Insurance

Driving a car is a privilege and a responsibility. It's essential to understand that driving without car insurance can lead to significant legal and financial repercussions. Car insurance provides a crucial safety net, protecting you and others in the event of accidents or other incidents.Legal Implications of Driving Without Car Insurance

Driving without car insurance is illegal in most states and can result in severe consequences. Here are some potential penalties:- Fines: You could face hefty fines, varying by state, for driving without insurance.

- License Suspension: Your driving license could be suspended, preventing you from driving legally.

- Impoundment of Vehicle: Your car could be impounded until you obtain insurance.

- Jail Time: In some cases, driving without insurance can even lead to jail time, particularly if you are involved in an accident.

Financial Implications of Driving Without Car Insurance

Driving without car insurance exposes you to substantial financial risks. If you're involved in an accident, you could be held personally liable for all costs associated with the accident, including:- Medical Expenses: If you or someone else is injured, you'll be responsible for their medical bills.

- Property Damage: You'll be responsible for repairing or replacing any damaged property, including your vehicle and the other driver's vehicle.

- Legal Fees: You could face significant legal fees if you're sued by the other driver or their insurance company.

Benefits of Having Car Insurance, Geico quote for car insurance

Car insurance provides essential protection in case of accidents or other incidents, safeguarding you from significant financial losses. Here are some key benefits:- Financial Protection: Car insurance covers your financial liabilities in case of accidents, preventing you from being personally responsible for substantial costs.

- Medical Coverage: Car insurance typically includes medical coverage for you and your passengers in case of an accident, ensuring you receive necessary medical treatment.

- Property Damage Coverage: Car insurance covers the cost of repairing or replacing your vehicle and the other driver's vehicle in case of an accident.

- Liability Coverage: Car insurance provides liability coverage, protecting you from lawsuits filed by the other driver or their passengers.

- Peace of Mind: Knowing you have car insurance provides peace of mind, allowing you to drive without worrying about the financial consequences of an accident.

Real-Life Examples of Car Insurance Protection

- Imagine a driver who loses control of their car and collides with another vehicle. Without insurance, they would be responsible for all medical expenses for the other driver, repairs to both vehicles, and any legal fees. Car insurance would cover these costs, protecting the driver from financial ruin.

- Another example is a driver who is hit by an uninsured motorist. Car insurance can cover the driver's medical expenses and property damage, ensuring they are not left to bear the financial burden alone.

Future Trends in Car Insurance

The car insurance industry is rapidly evolving, driven by technological advancements and changing consumer preferences. These trends are shaping how insurance is purchased, priced, and delivered, with significant implications for both insurers and policyholders.Impact of Technology on Car Insurance

Technology is playing a transformative role in the car insurance industry. Advancements in telematics, driverless cars, and artificial intelligence (AI) are creating new opportunities for insurers to personalize policies, improve risk assessment, and enhance customer experience.- Telematics: Telematics devices, often integrated into smartphones or connected car systems, collect data on driving behavior, such as speed, braking, and mileage. This data allows insurers to offer usage-based insurance (UBI) programs, where premiums are adjusted based on individual driving habits. For example, GEICO's DriveEasy program utilizes telematics to reward safe drivers with discounts.

- Driverless Cars: The emergence of autonomous vehicles is expected to significantly impact car insurance. Driverless cars are programmed to follow traffic rules and avoid accidents, potentially leading to a reduction in accidents and insurance claims. However, the liability for accidents involving autonomous vehicles is still being debated, and insurers are actively developing new coverage options for this emerging technology.

- Artificial Intelligence (AI): AI is being used to automate various aspects of the insurance process, from underwriting and claims processing to fraud detection. AI algorithms can analyze vast amounts of data to identify patterns and predict risks, leading to more accurate pricing and efficient claims handling.

Ultimately, securing the best GEICO quote for car insurance involves a combination of understanding your individual needs, exploring available coverage options, and strategically navigating the quote process. By leveraging the insights provided in this guide, you can confidently approach the world of car insurance, knowing you have the knowledge and tools to find the right coverage at a price that fits your budget.