Car insurance quotes Oklahoma: navigating the world of car insurance can be a daunting task, especially when you're looking for the best rates. With so many factors influencing your premiums, it's essential to understand the Oklahoma insurance landscape and how to find the most competitive quotes.

From legal requirements and coverage options to discounts and savings strategies, this comprehensive guide will equip you with the knowledge and tools to make informed decisions about your car insurance in Oklahoma. Whether you're a seasoned driver or a new motorist, understanding the intricacies of the insurance market is crucial to securing the best possible coverage at a price that fits your budget.

Discounts and Savings on Car Insurance in Oklahoma

Saving money on car insurance is a priority for most drivers, and Oklahoma residents have various options to lower their premiums. By understanding the available discounts and strategies, you can significantly reduce your insurance costs and keep more money in your pocket.

Common Car Insurance Discounts in Oklahoma

Many car insurance companies in Oklahoma offer a variety of discounts to their policyholders. These discounts can be based on various factors, such as your driving history, vehicle features, and lifestyle. Here's a list of some common car insurance discounts you might qualify for:- Good Driver Discount: This is one of the most common discounts, rewarding drivers with a clean driving record. Typically, a driver without any accidents or traffic violations for a specified period receives this discount.

- Safe Driver Discount: Similar to the good driver discount, this rewards drivers who have completed defensive driving courses or have a history of safe driving habits.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount. This discount is often offered as a percentage off your total premium.

- Multi-Policy Discount: This discount is available when you bundle your car insurance with other insurance policies, such as homeowners, renters, or life insurance.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, in your vehicle can make it less appealing to thieves and qualify you for this discount.

- Good Student Discount: Students with good grades, typically a GPA of 3.0 or higher, may be eligible for this discount.

- Mature Driver Discount: Drivers over a certain age, usually 55 or older, may qualify for this discount due to their generally lower risk of accidents.

- Military Discount: Active military personnel or veterans may receive discounts on their car insurance premiums.

- Loyalty Discount: Some insurance companies reward long-term customers with loyalty discounts.

Tips for Maximizing Car Insurance Discounts

While many discounts are automatic, some require you to take specific actions. Here are some tips for maximizing your car insurance discounts:- Maintain a Clean Driving Record: This is the most important factor in determining your eligibility for many discounts. Avoid traffic violations and accidents to ensure you qualify for the best rates.

- Shop Around and Compare Quotes: Different insurance companies offer varying discounts and policies. Compare quotes from multiple companies to find the best rates and discounts for your needs.

- Bundle Your Insurance Policies: Bundling your car insurance with other insurance policies, like homeowners or renters insurance, can lead to significant savings.

- Consider Safety Features: Installing anti-theft devices, airbags, or other safety features can lower your insurance premiums.

- Ask About Discounts: Don't hesitate to ask your insurance agent about all the discounts you might qualify for. They can help you understand your options and ensure you receive all the benefits you deserve.

Bundling Insurance Policies for Savings

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can result in significant savings. Insurance companies often offer discounts for bundling multiple policies, as they consider it a sign of customer loyalty and a lower risk. This discount can be substantial, depending on the specific policies and the insurance company.For example, a driver who bundles their car insurance with homeowners insurance might receive a 10% discount on their total premium. This discount can quickly add up and save you hundreds of dollars per year.

Choosing the Right Car Insurance Policy in Oklahoma

Finding the right car insurance policy in Oklahoma is crucial for protecting yourself financially in case of an accident or other unforeseen events. This involves more than just comparing prices; it requires careful consideration of various factors to ensure you have adequate coverage that meets your specific needs.Factors to Consider When Selecting a Car Insurance Policy

Choosing the right car insurance policy requires careful consideration of various factors. Here's a checklist to guide you through the selection process:- Your Driving History: Your driving record significantly impacts your insurance premiums. A clean record with no accidents or violations will generally result in lower rates. However, if you have a history of accidents or traffic violations, you might face higher premiums.

- Your Vehicle: The type of vehicle you own, its age, and its value influence your insurance premiums. Luxury or high-performance vehicles tend to have higher insurance costs due to their greater repair and replacement expenses.

- Your Location: The location where you live impacts your insurance premiums. Areas with higher rates of accidents or theft generally have higher insurance premiums.

- Your Coverage Needs: Determine the type and amount of coverage you need. Consider factors such as your vehicle's value, your financial situation, and your risk tolerance.

- Your Budget: Set a budget for your car insurance premiums and explore different policy options that fit within your financial constraints.

- Discounts: Explore available discounts, such as good driver discounts, multi-car discounts, and safety feature discounts, to potentially lower your premiums.

Understanding Policy Terms and Conditions

Thoroughly understanding the terms and conditions of your car insurance policy is essential. This includes:- Coverage Limits: Coverage limits define the maximum amount your insurance company will pay for specific types of claims, such as bodily injury liability, property damage liability, and collision coverage. Ensure these limits are sufficient to cover potential financial losses.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you'll need to be prepared to cover a larger portion of the costs in case of an accident.

- Exclusions: Exclusions are specific situations or events that are not covered by your policy. Carefully review these exclusions to understand what your policy does not cover.

- Renewal Terms: Understand the renewal terms of your policy, including how your premiums may change, the process for renewing, and any potential cancellation policies.

Customer Service and Claims Handling

Customer service and claims handling play a crucial role in choosing an insurance provider.- Responsiveness: Look for an insurance company with a reputation for prompt and helpful customer service. You want an insurer who responds quickly to your inquiries and provides clear and accurate information.

- Claims Process: Consider how the insurance company handles claims. A smooth and efficient claims process can save you time and stress in the event of an accident.

- Reputation: Research the insurer's reputation for customer satisfaction and claims handling. Check online reviews and ratings to get insights from other policyholders.

Car Insurance Claims Process in Oklahoma

Steps Involved in Filing a Car Insurance Claim

The first step is to report the accident to your insurance company as soon as possible. You should also contact the police if there are injuries or property damage.- Report the Accident: Contact your insurance company immediately to report the accident. Provide them with all the necessary details, including the date, time, location, and involved parties. You should also file a police report if there are injuries or significant property damage.

- Gather Information: Collect as much information as possible about the accident, including the names, addresses, and insurance information of all parties involved. Take photos of the damage to your vehicle and the accident scene.

- File a Claim: Follow your insurance company's instructions for filing a claim. This usually involves completing a claim form and providing supporting documentation, such as the police report, photos, and medical records.

- Cooperate with the Insurance Company: Respond promptly to any requests for information from your insurance company and be prepared to answer questions about the accident. You may be asked to provide a recorded statement.

- Seek Medical Attention: If you have been injured in the accident, seek medical attention immediately. Be sure to keep records of all your medical expenses.

Negotiating Settlements with Insurance Companies

Once your claim has been filed, the insurance company will begin its investigation. You may need to provide additional information or documentation, and they may send an adjuster to inspect the damage.- Understand Your Coverage: Before negotiating a settlement, it's important to understand the terms of your insurance policy. Know your coverage limits, deductibles, and any exclusions.

- Be Prepared to Negotiate: The insurance company may offer you a lower settlement than you believe is fair. Be prepared to negotiate and don't be afraid to ask for more.

- Get Legal Advice: If you're not comfortable negotiating with the insurance company on your own, consider seeking legal advice from an experienced car accident attorney.

Tips for Ensuring a Smooth and Efficient Claims Experience

- Be Organized: Keep all your documentation related to the accident in a safe and organized place. This includes the police report, photos, medical records, and any other relevant information.

- Communicate Clearly: Communicate with your insurance company in a clear and concise manner. Be honest and accurate in your responses.

- Be Patient: The claims process can take time. Be patient and understanding with your insurance company.

Tips for Safe Driving in Oklahoma: Car Insurance Quotes Oklahoma

Oklahoma's diverse landscape and weather conditions present unique challenges for drivers. It's crucial to be aware of these challenges and adopt safe driving practices to minimize the risk of accidents. This section provides tips for safe driving in Oklahoma, covering common driving hazards and the importance of regular vehicle maintenance.Common Driving Hazards in Oklahoma

Oklahoma's weather can be unpredictable, ranging from extreme heat and humidity in the summer to icy and snowy conditions in the winter. These conditions can significantly impact road safety. Here are some common driving hazards in Oklahoma:- Severe Weather: Oklahoma is prone to severe weather events, including tornadoes, thunderstorms, and hailstorms. These events can cause sudden changes in visibility, road conditions, and even structural damage to vehicles.

- High Winds: Oklahoma's open plains and flat terrain can create strong winds, especially during thunderstorms. These winds can make it difficult to control a vehicle, particularly for larger vehicles or those with high profiles.

- Fog: Fog can significantly reduce visibility, making it difficult to see other vehicles and road signs. Fog is more common in the early morning and late evening hours, especially during the fall and spring seasons.

- Wildlife: Oklahoma is home to a variety of wildlife, including deer, elk, and other animals. These animals can cross roads unexpectedly, especially during dawn and dusk hours.

- Construction Zones: Construction zones are common in Oklahoma, particularly during the summer months. These zones can create traffic delays and unexpected hazards, such as lane closures and reduced speed limits.

Importance of Regular Vehicle Maintenance

Regular vehicle maintenance is essential for ensuring safe driving. By keeping your vehicle in good working order, you can reduce the risk of breakdowns and accidents. Here are some key maintenance tasks:- Tire Pressure: Properly inflated tires improve handling, braking, and fuel efficiency. Check tire pressure regularly, especially before long trips.

- Fluid Levels: Ensure that engine oil, coolant, brake fluid, and power steering fluid are at the appropriate levels.

- Brakes: Have your brakes inspected regularly to ensure they are in good working condition.

- Lights: Check all lights, including headlights, taillights, brake lights, and turn signals, to ensure they are working properly.

- Windshield Wipers: Replace worn windshield wiper blades to ensure clear visibility during rain and snow.

Resources for Oklahoma Drivers

Navigating the roads of Oklahoma can be a breeze with the right resources at your fingertips. From government agencies to insurance companies and consumer advocacy groups, there's a wealth of information and support available to help you stay safe and informed.Government Agencies

Government agencies play a crucial role in ensuring the safety and well-being of Oklahoma drivers. They provide essential services, regulations, and resources to help you navigate the roads safely and responsibly.- Oklahoma Department of Public Safety (ODPS): The ODPS is the primary agency responsible for issuing driver's licenses, vehicle registrations, and enforcing traffic laws. They offer a range of services, including driver education courses, background checks, and vehicle title transfers. You can visit their website at [website address] or call [phone number] for more information.

- Oklahoma Department of Transportation (ODOT): The ODOT manages Oklahoma's transportation infrastructure, including highways, bridges, and public transportation systems. They provide real-time traffic updates, road closure information, and road construction notices. You can visit their website at [website address] or call [phone number] for more information.

- Oklahoma Highway Patrol (OHP): The OHP is the state's law enforcement agency responsible for patrolling highways and enforcing traffic laws. They provide assistance to motorists in emergencies, investigate traffic accidents, and enforce speed limits and other traffic regulations. You can contact them by dialing [phone number] for assistance.

Insurance Companies

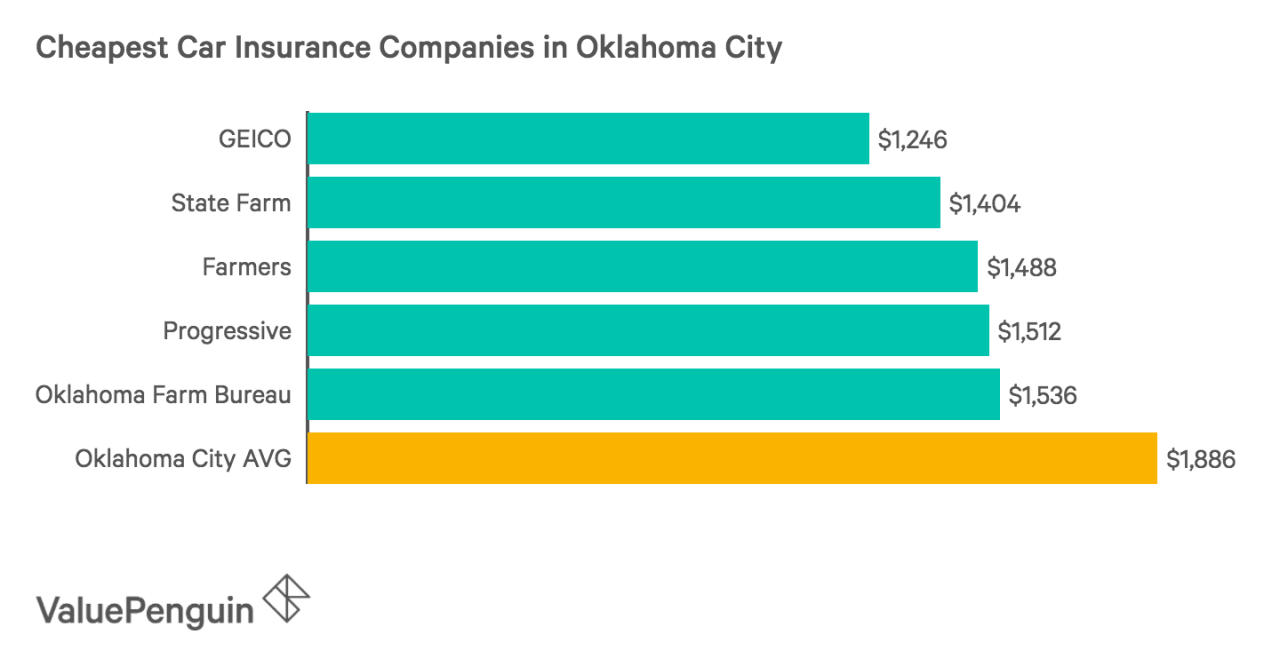

Car insurance is a necessity for Oklahoma drivers. It provides financial protection in case of an accident, theft, or other unforeseen events. Choosing the right insurance policy can be overwhelming, so it's essential to shop around and compare quotes from different companies.- State Farm: State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products, including car insurance. They have a strong reputation for customer service and financial stability. You can visit their website at [website address] or call [phone number] for a quote.

- Progressive: Progressive is another major insurance company known for its innovative products and services. They offer a variety of car insurance options, including personalized coverage plans and discounts. You can visit their website at [website address] or call [phone number] for a quote.

- Geico: Geico is a popular insurance company known for its competitive rates and convenient online services. They offer a range of car insurance options, including discounts for good drivers and safe driving practices. You can visit their website at [website address] or call [phone number] for a quote.

Consumer Advocacy Groups

Consumer advocacy groups play an important role in protecting the rights and interests of Oklahoma drivers. They provide valuable resources, advice, and support to help you navigate the complexities of the insurance industry and resolve any disputes you may have.- Oklahoma Insurance Department: The Oklahoma Insurance Department is the state agency responsible for regulating the insurance industry. They provide consumer education materials, handle complaints, and investigate insurance fraud. You can visit their website at [website address] or call [phone number] for more information.

- Better Business Bureau (BBB): The BBB is a non-profit organization that provides ratings and reviews of businesses, including insurance companies. They can help you research different insurance providers and make informed decisions. You can visit their website at [website address] or call [phone number] for more information.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including car insurance. They offer valuable insights into the pros and cons of different insurance companies and policies. You can visit their website at [website address] for more information.

Financial Assistance for Drivers in Need, Car insurance quotes oklahoma

Life can throw curveballs, and sometimes drivers find themselves facing financial challenges that make it difficult to afford car insurance or other transportation expenses. There are organizations that offer financial assistance to drivers in need, providing a lifeline during difficult times.- United Way of Oklahoma: The United Way of Oklahoma is a non-profit organization that provides a range of services to low-income families and individuals, including financial assistance for transportation needs. You can visit their website at [website address] or call [phone number] for more information.

- Salvation Army: The Salvation Army is a faith-based organization that offers financial assistance to individuals and families facing hardship. They may provide temporary assistance with car insurance premiums or other transportation expenses. You can visit their website at [website address] or call [phone number] for more information.

- Local Churches and Community Organizations: Many local churches and community organizations offer financial assistance programs to help individuals in need. Contact your local church or community center for information about available resources.

Driver Education Programs

Driver education programs are essential for new drivers and experienced drivers alike. They provide valuable skills and knowledge to help you become a safe and responsible driver.- Oklahoma Department of Public Safety (ODPS): The ODPS offers driver education programs for new drivers, including classroom instruction and behind-the-wheel training. You can visit their website at [website address] or call [phone number] for more information.

- Driving Schools: Many private driving schools offer driver education programs tailored to different age groups and skill levels. They provide comprehensive instruction on traffic laws, safe driving techniques, and defensive driving strategies. You can search online or contact your local community center for information about available driving schools.

- AAA: The American Automobile Association (AAA) offers driver education programs for teens and adults, including defensive driving courses and advanced driving skills training. You can visit their website at [website address] or call [phone number] for more information.

Car Insurance Trends in Oklahoma

The Oklahoma car insurance market is constantly evolving, driven by factors such as technological advancements, changing driver demographics, and legislative updates. Understanding these trends can help Oklahoma drivers make informed decisions about their insurance coverage and find the best deals.Impact of Technology on Car Insurance

Technology is revolutionizing the car insurance industry in Oklahoma, offering new ways to assess risk, manage policies, and handle claims.- Telematics: Telematics devices, often integrated into smartphones or connected car systems, track driving habits like speed, braking, and mileage. Insurance companies use this data to offer discounts to safe drivers and personalize premiums based on individual driving behavior.

- Artificial Intelligence (AI): AI algorithms are used to analyze large datasets of driving records, claims history, and other factors to assess risk and set premiums more accurately. This can lead to more personalized pricing and potentially lower premiums for low-risk drivers.

- Digital Platforms: Online platforms and mobile apps make it easier for Oklahoma drivers to compare quotes, manage policies, file claims, and access customer support. This increased convenience and transparency can empower drivers to make informed choices about their insurance.

By understanding the key factors that influence car insurance quotes in Oklahoma, comparing quotes from multiple providers, and taking advantage of available discounts, you can find the right car insurance policy that meets your needs and fits your budget. Remember, the journey to finding the best car insurance starts with knowledge and informed decision-making.

Getting car insurance quotes in Oklahoma can be a bit of a chore, but it doesn't have to be a stressful experience. You can save time and money by comparing quotes online, and a great place to start is by checking out resources that offer cheap online car insurance quotes. This will help you get a good idea of what rates are available in Oklahoma, and you can then narrow down your choices to find the best coverage for your needs and budget.

Finding the right car insurance in Oklahoma can be a bit of a challenge, especially when you're looking for the best rates. If you're looking to save money, it's worth exploring the world of low car insurance quotes to see what deals are out there. Remember, even small savings can add up over time, so don't hesitate to shop around and compare quotes in Oklahoma.